How Much Do Workers Comp Lawyers Charge?

How Much Do Workers Comp Lawyers Charge? Workers’ Compensation Attorney Fees Explained for 2025

Understanding Workers’ Comp Lawyer Fees in 2025

Choosing the right workers’ compensation attorney is a crucial step for any injured worker, but knowing how much workers comp lawyers charge in 2025 is just as important. Legal fees can shape your path to justice and financial recovery, so it’s vital to understand how these charges are determined, what sets them apart from fees in other practice areas, and how fee arrangements will impact you as the client. The following sections break down the unique aspects of workers’ compensation attorney fees, offering clear and practical insights to help you make informed financial decisions during your recovery journey.

What Makes Workers’ Compensation Attorney Fees Unique?

Unlike many other areas of law, workers’ compensation attorney fees in 2025 remain distinctive for their structure, predictability, and client-focused protections—making it essential for injured workers to understand how much do workers comp lawyers charge before proceeding with a claim. In most states, these fees are statutorily regulated; this means courts or administrative bodies often set hard limits on the percentage or amount that can be charged, directly tying your attorney’s payment to the actual compensation you receive. This regulatory oversight benefits clients, as it prevents exorbitant legal bills and ensures transparency from the start. So, when you’re searching for guidance after an injury, you can trust that the legal costs will be fair and not erode the financial stability you’re fighting to regain.

Most lawyers work on a contingency fee basis, a structure purpose-built for injury cases where clients may not have the means to pay upfront. In practical terms, “contingency” means your lawyer receives a set percentage—almost always capped—only if they help you recover benefits or reach a favorable settlement. This unique arrangement aligns your attorney’s goals with your own: maximizing your award. It also motivates law firms like Vassallo, Bilotta & Davis to fight vigorously for each client, since their potential earnings depend on the outcome. That way, the answer to “how much do workers comp lawyers charge” becomes a practical concern only after you’ve secured results.

Fee arrangements in workers’ comp claims are further distinguished by the level of oversight, ethical standards, and client protections they must meet. States often require legal fees to be approved by a judge or commission before any payment is made. This extra step creates an added layer of security for injured workers, reducing the risk of surprises and ensuring fees remain reasonable in light of the benefits secured. From your FREE first consultation to the closing of your case, transparency remains central. Top law firms—like Vassallo, Bilotta & Davis—will discuss how much workers comp lawyers charge clearly and upfront, supporting your ability to plan ahead, access justice confidently, and stay focused on your recovery. If you have questions or concerns about fee structures, don’t hesitate to reach out for a personalized explanation tailored to your situation.

How Contingency Fees Work in Workers’ Compensation Cases

Navigating the costs of legal representation can feel daunting, especially when recovering from a workplace injury. Fortunately, contingency fee structures in workers’ compensation cases are designed to empower injured workers, ensuring access to justice without upfront financial barriers. In these arrangements, attorneys are compensated only if they recover money for you, typically as a percentage of your total award. This section breaks down the typical percentage ranges, common payment structures you can expect, and why these arrangements help level the playing field for clients. With this understanding, you’ll know exactly how contingency fees align with your interests and support your recovery.

Typical Percentage Ranges and Payment Structures

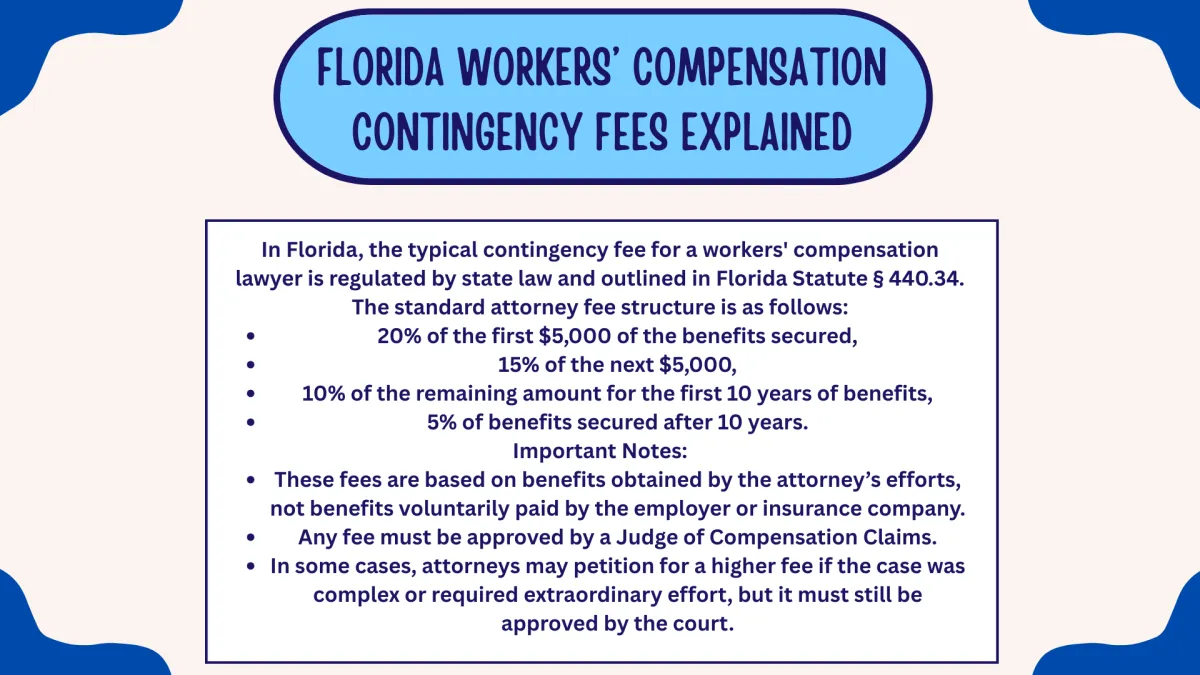

When you’re evaluating a workers’ compensation lawyer, understanding the typical percentage ranges and payment structures can make a significant difference in your decision-making process. Most states set legal limits on what attorneys can charge in workers’ compensation cases, which serves as an essential protection for injured workers who are often already facing financial stress. Generally, contingency fees in these cases range from 10% to 25% of the benefits or settlement secured for the client, with the exact percentage often determined by state regulations or the complexity of the case (see the chart below for the Florida Statute on Workers Compensation Fees). This regulated approach not only brings peace of mind, but also fosters fairness and predictability in what you’ll pay if your case is successful.

The payment structure itself is straightforward: workers’ comp attorneys do not receive compensation unless they win your case or negotiate a settlement.

This “no win, no fee” principle means that injured workers can access legal counsel without taking on the risk of added expenses during difficult times. Some jurisdictions may have tiered fee systems, where different rates apply depending on how far your claim progresses—often with lower percentages for settlements secured early in the process and slightly higher ones if the case must proceed to a hearing or appeals stage. However, these caps are strictly monitored by state workers’ compensation boards or judges, ensuring that paying for a lawyer never eats away an excessive portion of your recovery.

For injured workers seeking to maximize their claims, this arrangement aligns both your interests and your attorney’s. Law firms like Vassallo, Bilotta & Davis are motivated to achieve the best possible result for you because their compensation depends on it. Transparency is also a hallmark: contingency fee agreements must be documented in writing and approved by the relevant authorities, so you’re never left in the dark about your potential financial obligations. Before signing on with an attorney, you should always review —and feel free to question—the exact terms of your fee agreement, including any state specific caps and provisions for costs outside the core legal fee (which will be discussed in upcoming sections). This due diligence ensures you fully understand your financial commitments and helps you plan confidently for the road ahead, knowing exactly how and when your lawyer will be paid.

Additional Legal Expenses Beyond Attorney Fees

After gaining a clear understanding of how workers’ compensation attorney fees are structured and regulated, it’s important for injured workers to recognize there are other legal expenses that may arise during the course of a claim. These out-of-pocket costs, while separate from the lawyer’s contingency fee, can still have a direct impact on your financial planning and recovery journey. Knowing what to expect empowers you to avoid surprises, budget more effectively, and approach each step of your case with added peace of mind. Let’s explore the most common additional expenses that workers should anticipate and practical tips on managing them.

Common Out-of-Pocket Costs for Injured Workers

While the majority of workers’ compensation attorneys operate on a contingency fee — meaning you don’t pay those fees unless your case is successful—there are several important out-of-pocket costs that can arise as your claim progresses. These ancillary legal expenses are distinct from your attorney’s compensation and are designed to cover actual expenses the law firm incurs while building a strong case on your behalf. Recognizing and preparing for these costs is crucial, especially since they can affect your overall recovery amount and financial stability during an already challenging time.

One of the most prevalent out-of-pocket costs is the fee for obtaining medical records. Because medical documentation is central to proving both the nature and extent of your workplace injury, lawyers must collect comprehensive records from every relevant provider. Healthcare facilities may charge for copies and administrative processing—costs typically passed on to the client either during the case or upon a successful resolution. Similarly, expert witness fees can be significant. If your case requires testimony from a vocational expert, physician, or specialist to validate your injury, their preparation and appearance come with associated charges. In complex cases, expert opinions can be the difference maker, but these professionals charge for their time regardless of case outcome.

Court filing fees, service of process charges (for delivering legal documents to opposing parties), and deposition costs (the expense of taking sworn witness statements) are also common. Some states allow for mileage reimbursement, copying fees, or costs related to acquiring surveillance footage or workplace safety reports—each adding to the financial puzzle. Knowledgeable law firms like Vassallo, Bilotta & Davis strive for transparency about these expenses from the outset, helping you understand which are likely unavoidable and which may be negotiable or eligible for reimbursement if you win your case.

Managing these out-of-pocket costs starts with asking direct questions at your initial consultation. Are these fees advanced by the attorney and reimbursed from your eventual settlement, or are you responsible for payment as they arise? Reputable firms often front many costs to minimize your upfront stress, recouping them only if your case succeeds. Still, it’s vital to clarify this point and get it in writing within your fee agreement. Don’t hesitate to ask for itemized estimates so you can budget accordingly or explore financing options if needed. If you’re ever unsure about a charge, press for details—transparency is a hallmark of firms who put your best interests first. By proactively addressing these expenses, you’ll protect your financial health and confidently navigate the next stages of your workers’ compensation claim.

State-by-State Variations in Workers’ Comp Attorney Fees

Understanding the differences in workers’ compensation attorney fees across state lines is pivotal for injured workers looking to make informed decisions after a workplace injury. While previous sections have outlined the general principles behind attorney fee arrangements and additional legal expenses, it’s equally crucial to recognize that not all states follow the same rules—or charge the same amounts. Variances in local law, regulatory oversight, and fee structures can significantly affect what you’ll ultimately pay for representation. Here, we’ll hone in on how these state-by-state differences manifest, starting with the important role local regulations play in determining attorney charges.

How Local Regulations Impact What Lawyers Can Charge

The amount a workers’ compensation attorney can charge is closely linked to the regulatory environment in each state—a fact that often catches injured workers off-guard when they begin their search for representation. Unlike standardized national practices, each state’s workers’ compensation board, legislature, or judiciary sets its own rules, caps, and approval processes for legal fees. Some states impose firm percentage limits, such as a maximum of 10%, 15%, or 20% of your total benefits or settlement, while others use tiered scales based on case complexity or the stage at which a resolution is reached. There are also states where judges have substantial discretion, approving fees based on what’s considered reasonable and fair for the unique circumstances of each case.

For example, an injured worker in Florida currently faces a strict cap of 20% for the first $5,000 of recovered benefits and 15% for any amount beyond that, reflecting an intent to protect workers from excessive legal costs. In contrast, states like California operate under a more flexible system—judges review fee petitions in light of the specific work performed and the result obtained, sometimes awarding a higher percentage if the claim required exceptional legal skill or resulted in a particularly favorable settlement. Meanwhile, New York applies a schedule where fees are not predetermined but instead must be approved—on a case-by-case basis—by a workers’ compensation law judge, who weighs the complexity and outcome of the matter in question.

These local differences do more than just dictate numbers—they directly affect the relationship between attorney and client and shape the advice you’ll receive about

navigating your claim. Some states mandate fee agreements in specific language and formats; others require frequent disclosures or even court hearings to ensure every charge is justified. This patchwork of rules has a real-world impact on how accessible legal representation remains for injured workers: tighter caps may help ensure the bulk of your settlement goes rightfully to your recovery, but they can also affect the willingness of some attorneys to take on especially challenging or low-value cases. For clients of Vassallo, Bilotta & Davis, we emphasize transparency, compliance, and putting your interests first in every jurisdiction where we operate. If you have questions about your state’s rules or how they might influence your total costs, it’s smart to raise them early—your attorney should be ready and able to explain not only what’s allowed locally, but what’s most advantageous for you as you pursue your benefits.

Tips for Managing and Negotiating Workers’ Comp Legal Fees

Securing fair legal representation after a workplace injury isn’t only about choosing the right lawyer—it’s about understanding the strategies that help you manage and negotiate the fees that come with your workers’ compensation claim. Equipped with insights from previous sections on fee structures and out-of-pocket costs, you can now take proactive steps to ensure your financial interests are protected. This section offers practical guidance on navigating fee agreements, asking the right questions before hiring an attorney, and setting clear expectations, so you can move forward with confidence and stay focused on your recovery, rather than being blindsided by unexpected legal costs.

Questions to Ask Before Hiring an Attorney

Engaging a workers’ compensation attorney is a key investment in your future wellbeing, but it’s important to get clarity on every aspect of the fee arrangement before moving forward. When sitting down for your initial consultation—or even during your first call—you should come prepared with targeted questions that open a window into the lawyer’s approach,

transparency, and client advocacy. One of the most effective ways to take ownership of the process is to ask how the fee percentage was determined, if it’s negotiable within state regulations, and whether there are scenarios that could change your costs as your case progresses. This is your opportunity to benchmark what’s standard in your state against the

specific terms offered by the law firm, ensuring you’re not agreeing to anything out of line with local norms or statutory requirements.

Go beyond the percentage: request an itemized outline of potential “other” costs, such as court fees, expert witness expenses, or charges for acquiring medical records. Ask directly whether these costs will be advanced by the firm and only deducted upon a favorable resolution, or if you’ll be responsible for ongoing payments along the way. Clarifying this point, as discussed in earlier sections, will help you avoid unexpected out-of-pocket bills that can strain your finances when you most need peace of mind. Don’t hesitate to ask for a copy of the fee agreement before you sign, and make sure you understand every clause. If any language is unclear, ask the attorney to break it down or provide real-world examples based on cases similar to yours.

Transparency and accessibility are hallmarks of outstanding law firms like Vassallo, Bilotta & Davis—so use your consultation to assess whether you’re getting forthright, thorough answers. Explore whether the firm’s history reflects success in negotiating fee reductions in special circumstances or if they offer alternative billing structures for particularly challenging

or straightforward claims. Gauge the willingness of your attorney to educate you about local caps, regulatory approvals, and how unforeseen developments might impact your ultimate fees. Remember, your initial questions set the tone for the client-attorney relationship; you want a legal partner who respects your right to full financial clarity, advocates on your behalf,

and arms you with knowledge to negotiate when possible. By approaching this step methodically and assertively, you transform the process from intimidating to empowering — ensuring that whatever challenges your workers’ comp case presents, you remain in control of your financial future.